For more than two centuries, economists and well-read people have understood that tariffs reduce the levels of competitiveness and prosperity. Adam Smith (1723-1790) explained how free trade (by increasing the extent of the market) enabled greater specialization and productivity, and David Ricardo (1772-1823) explained how free trade allowed for “comparative advantage” to everyone’s benefit.

President Trump, despite claims that he is really a free trader, does not seem to fully appreciate the dangers of the tariff wars that he is undertaking. This past Friday, Mr. Trump threatened Mexico with a 5 percent tariff if the Mexican government did not do more to curb illegal immigration from Mexico into the United States. No doubt, Mexico could and should do far more to discourage illegal immigration into the United States, but using the threat of tariffs is both economically risky and inappropriate.

Americans and Mexicans buy hundreds of billions of dollars in goods and services from each other each year. A tariff on Mexican goods will increase prices to American consumers. Mexico has a fragile economy, and a new tariff on their goods means that many Mexican workers will lose their jobs — and some number of these newly unemployed are likely to try to enter the United States to find work — making the immigration problem worse.

Tariffs are a blunt instrument that disrupt supply chains, and often have many unforeseen and harmful economic consequences. If the president really believes that he needs to engage in some sort of economic warfare to change Mexico’s behavior, there are a number of targeted financial sanctions and impediments that he could use — such as a tax on remittances, and restrictions on certain cross border financial payments — which would be far less onerous on U.S. persons and businesses, and might well be equally or even more effective. These are all bad ideas but not as bad as a tariff. A scalpel can be more effective than a meat axe and will do far less collateral damage.

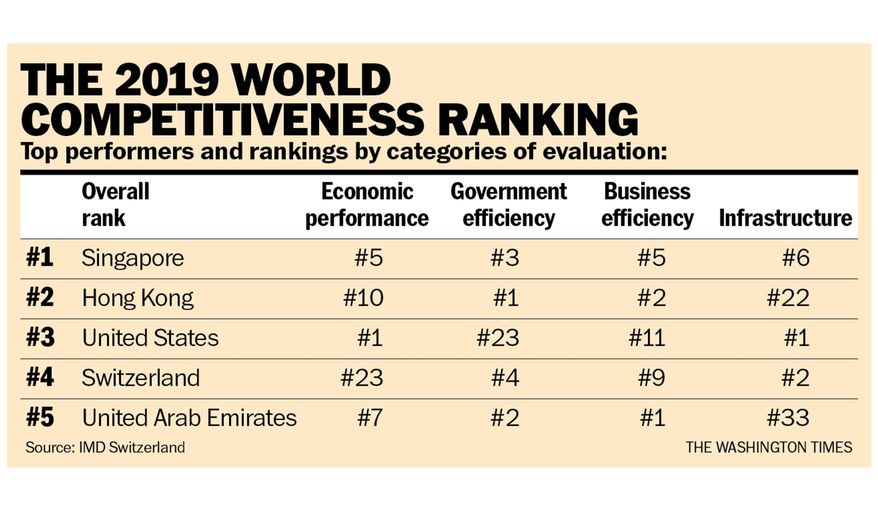

This past week, the highly ranked IMD graduate business school in Lausanne, Switzerland released its annual ranking of countries international competitiveness. (Note: A number of both government and non-government organizations around the world issue similar or related rankings each year. As would be expected, the same countries tend to be near the top in most lists, and the same countries at the bottom. Top-ranked countries tend to have high per capita incomes which are a direct result of having the rule of law, considerable economic freedom, including the free movement of both labor and capital, largely unregulated markets, relatively low tax rates, including no or very low tariffs on average, and stable money.)

Singapore and Hong Kong are ranked number one and two. Both are free-trade jurisdictions — that also have the rule of law, very low taxes and regulations, free markets and limited government. The United States and Switzerland have on average very low tariffs. (President Trump voices frustration that most countries can send most of the goods and services to the United States tariff-free or at most very low tariffs, while many of them have tariffs and other significant barriers to U.S. goods and services. This may be “unfair,” but putting a tax, i.e. tariff, on ourselves only makes Americans poorer.) Singapore, Hong Kong, Switzerland and the UAE all have higher per capita incomes than the United States.; in fact, Singapore now has a per capita income more than 50 percent higher than the United States, despite a total lack of natural resources.

The United States ranks high in most areas of “international competitiveness,” except for government efficiency — which unfortunately will not shock any American. According to the IMD, the United States is number one in “infrastructure,” using a broader definition than is common in the United States. The IMD includes institutions and such things as educational opportunity and labor mobility. Most Americans are not aware that the United States has the best and most efficient freight rail system in the world. Many airports are in need of renovation and expansion, but there is no place else in the world where the volume and frequency of flights at low cost is so available.

The fact that anyone can drive from any city to any other city in American (three million square miles) on a high-speed road without encountering a stop light is unique on the planet, and greatly adds to transportation efficiency, and hence lower-cost goods.

Americans cannot control the bad behavior of foreign governments, including the many destructive economic policies that cause misery among their own people. Rather than emulate these bad policies, such as tariffs, high taxes, destructive regulation, big and inefficient government programs, etc., the United States should serve as an example of the benefits that free trade, reasonably low taxes, the rule of law, etc. provide in prosperity and jobs, and encourage other countries to emulate us, rather than vice-versa.

Richard W. Rahn is chairman of the Institute for Global Economic Growth and Improbable Success Productions

https://www.washingtontimes.com/news/2019/jun/3/tariffs-competitiveness-and-prosperity/