Mystery solved. What has President Biden been doing in the unusual amount of time he spends without anything on his schedule? By his own words, we know he is counting the number of potato chips and other snack foods in a bag — and by golly, he has promised to stop this product shrinkage and punish the greedy food companies.

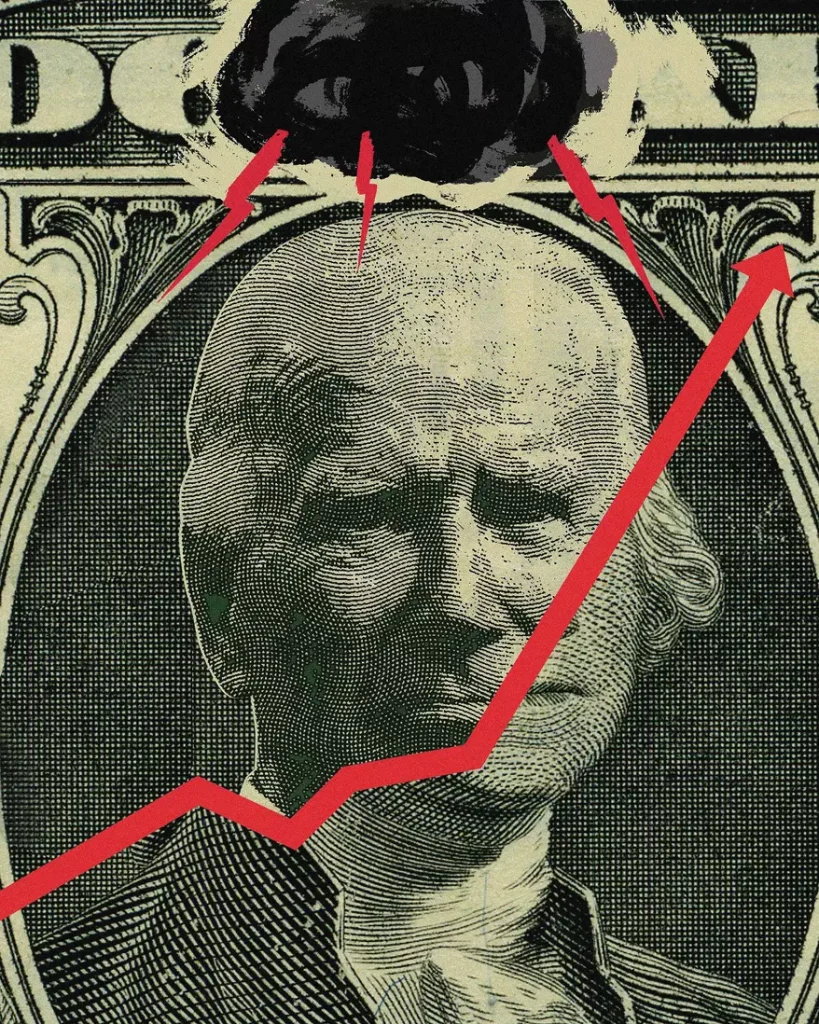

A small potato chip company operating with a modest margin finds that, due to general inflation, costs have risen sharply for potatoes, vegetable oil, rent, machinery, labor, etc. Facing this problem, the company can either raise prices or reduce the amount of product in a bag and continue to sell it at the old price. Businesses have learned there is often less consumer resistance to a reduction in portion size than a price increase — so fewer chips per bag. But in the end, it is the same thing — the consumer is paying more per chip. The president calls this “shrinkflation.” He should know. He caused it.

Mr. Biden often acts as if inflation came from the tooth fairy (or “greedy businessmen”) rather than as a result of the actions and policies of his own government. Among Mr. Biden’s many misstatements (in perhaps the worst State of the Union address ever) was his claim that U.S. inflation is “the lowest in the world.” In fact, China, Japan, Canada, Switzerland, and the whole euro area, among other jurisdictions, have lower inflation rates.

Politicians have complained about high prescription drug prices for decades, noting that many pills cost relatively little to produce. What they are choosing to ignore or don’t understand is the difference between average and marginal cost. The research and development costs of many drugs run into tens of millions or even hundreds of millions of dollars. Most drugs have limited markets in that not many people have the specific disease or conditions that the drug treats. The marginal production cost of a drug may be only $5 per pill, but the average cost (to cover R&D and Food and Drug Administration approval) per pill may be $700, causing consumers and politicians to scream about high drug prices. Mr. Biden and many other politicians are demanding price controls — which have failed virtually every time they have been tried. No rational pharmaceutical company will spend huge amounts of money developing new, lifesaving drugs if it cannot recoup full development costs. This is basic economics that the political class chooses to ignore — but those who die because of the lack of new drugs no longer vote.

The president has proposed many new spending programs and subsidies for favored constituencies. Almost all politicians do this to a greater or lesser extent while ignoring how to pay for it. Most governments are well above optimum size — meaning that at some point, almost all spending programs no longer meet a cost-benefit test (many of them never did). And many cost-benefit studies ignore the acquisition costs of obtaining the funds.

Mr. Biden claimed that the “rich and corporations” will pay for his spending programs. Politicians have been making this claim since at least the introduction of the income tax in 1913 — and of course, it never happens. Mr. Biden and the other big taxers keep up the refrain about wanting the rich to “pay their fair share” while refusing to say what a fair number is.

One of the problems with trying to tax the rich is that they and their capital can move. New York Gov. Kathy Hochul recently stated that her tax base had moved to Palm Beach. Surprise, surprise — people move from higher to lower tax jurisdictions, which happens between U.S. states and countries.

Many studies are showing that the high marginal tax rates do not bring any added income to governments (people have legal and illegal ways of moving income and wealth). High tax rates, however, discourage capital investment, job creation and economic growth. Billionaire Ken Griffin and his Citadel Fund recently moved to Florida from Illinois. Already, he has made many large investments in Florida, along with huge donations to various Florida charities. The benefit from businesses Mr. Griffin, Jeff Bezos, Elon Musk, and the other super-rich create and charities they support in their chosen locales is many times the direct tax that any government could expect to get from them.

Mr. Biden has been saying for more than four years that no one making less than $400,000 a year under his proposal will pay one penny more in taxes — but after inflation, $400,000 is already down to about $350,000 in purchasing power. In an inflationary environment, such promises don’t mean much.

Mr. Biden’s home state of Delaware has favorable tax and regulatory rules for corporations, greatly benefiting the state — which Mr. Biden has defended and bragged about. Pension funds own a large percentage of many American corporations whose profits fund retiree pensions. Higher taxes on corporations mean lower wages, higher prices and smaller pensions. All too many in the political class, including Mr. Biden, prefer to exploit economic ignorance rather than teach and practice sound economic policy. Shame on them.

• Richard W. Rahn is chairman of the Institute for Global Economic Growth and MCon LLC.

https://www.washingtontimes.com/news/2024/mar/11/biden-is-ultimately-responsible-for-shrinkflation/

© Copyright 2024 The Washington Times, LLC.