Congress just passed a $1.7 trillion (that is trillion with a T) budget that President Biden has signed. Those who voted for it claimed it was a Christmas gift to the American people, when in actuality it was a stocking full of coal (and most people had not even been naughty in 2022). What the Congress did was go into your bank account, take whatever money you had, and then leave you a note saying you will still owe them forever even if you don’t have the money to pay. Congress also greatly increased the IRS budget, just to make sure there are enough IRS thugs to give every taxpayer (except those who are politically protected) an “offer that you can’t refuse.”

The budget bill is very destructive to the American economy — so, are members of Congress just ignorant of fundamental economics, mean-spirited or grossly irresponsible? All of the Democrats voted for it — as was expected — because many of them tout their economic know-nothingism as a badge of honor. What is surprising and disappointing is that 18 Republican senators and seven Republican representatives also voted for it. Republicans are supposed to be the adults in the room when it comes to economic issues. Oh, well.

At one time, there were some Democrats who knew a bit about economics and were often responsible. For example, the famous and very colorful Sen. Russell Long, the Louisiana Democrat who served from 1948 until 1987, was chairman of the Senate Finance Committee for many years. He was overweight and drank too much, but he was very smart and funny, and he knew the tax code better than most anyone, while having a good grasp of economic reality. Long, for the most part, had a constructive relationship with the Reagan administration and was able to work with them on tax and spending reform rather than sabotaging the whole effort, which he might have been able to do. He probably would have been appalled at the current level of non-defense spending, which is about 50% higher as a percentage of GDP than when he retired in 1987, and where deficits have gone from less than 50% of GDP to more than 100%.

There was a time when the Democrats would have tried to close the budget deficit gap with tax increases, as President Jimmy Carter attempted to do. Fifteen years earlier, President John F. Kennedy cut taxes to spur growth — which worked — but was a lesson that Mr. Carter missed. Many Democrats still seem not to understand the difference between tax rates and tax revenue, as evidenced by the tax increases in the just-passed budget.

Fortunately, most Republicans and some Democrats now understand that higher tax rates are likely to lower long-term tax revenue because of slower growth caused by the greater disincentives to save, invest and work. This gain in economic literacy may be due more to the tireless teaching of Arthur Laffer (of the Laffer Curve fame) than any other single individual. Mr. Laffer, a protégé of Nobel Laureates Milton Friedman and Bob Mundell, has the unique ability to explain fundamental economic concepts in ways that almost anyone can quickly understand — which he has now been doing with energy and enthusiasm for half a century. Some in the media and economics profession have claimed that Mr. Laffer is not a serious economist because he is so easily understood when the contrary is true. If other economists and economic commentators had a fraction of the understanding of economics that Mr. Laffer does, they might also be able to communicate in a way that does not appear to be gibberish.

Mr. Laffer never gives up preaching good economics in numerous TV appearances on the leading financial shows, even though he could have comfortably retired long ago. His new book, “Taxes Have Consequences: An Income Tax History of the United States” (co-authored with Brian Domitrovic and Jeanne Cairns Sinquefield), is a good and useful read for those interested in how we got into the tax mess, and more importantly how we get out of it. The last sentence is a good summary: “History shows that the Laffer curve works; the optimal tax rate is closer to sub-20 percent than up near 70 percent; and the government needs to seriously second-guess itself when it begins to find tax-rate increase arguments convincing.”

Studies also show that the growth maximizing rate of government spending appears to be less than 20%. Another fine economist who provides exceptionally clear explanations about the optimal level of government spending is Dan Mitchell, whose work can be found on the blog International Liberty.

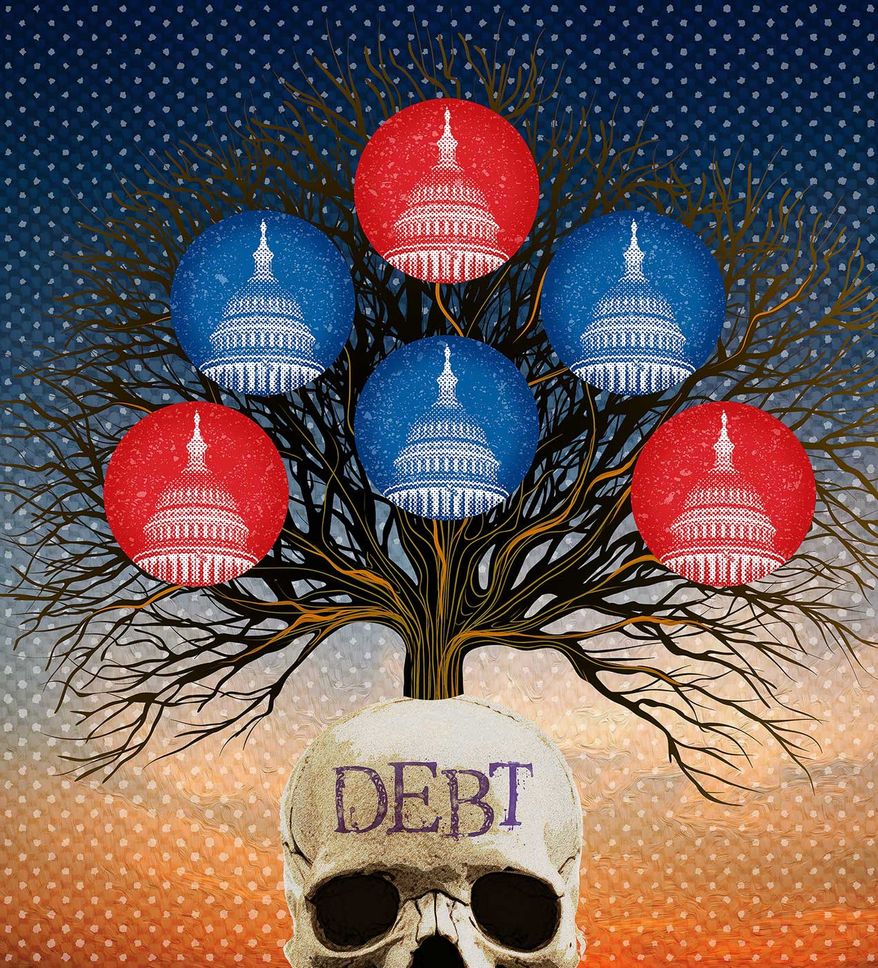

The Congressional Budget Office projections show ever-increasing debt as a percentage of gross domestic product, which of course is unsustainable. Despite ever-increasing debt, the U.S. government will not go bankrupt in the traditional sense because it prints its own money, but the money that it creates will be worth less and less (which we call inflation). At some point, a devalued currency and increasing interest payments on the debt will crowd out other government spending that there will be no choice but economic reform, including a return to commodity-backed money. Happy new year!

• Richard W. Rahn is chairman of the Institute for Global Economic Growth and MCon LLC.

https://www.washingtontimes.com/news/2022/dec/27/congress-17-trillion-irresponsible-christmas-gift-/

© Copyright 2022 The Washington Times, LLC.