As we sit down to enjoy Thanksgiving today, it is worth noting that it has been 234 years since George Washington first proclaimed it a national holiday to give thanks for our bounty and liberty.

In part, the U.S. has prospered because our forefathers had the ability to move to wherever they thought would be greener pastures.

Before the 1870s, there were no real immigration laws. People from whatever country, provided they had the money, just picked up and moved to wherever they wanted to go, much as people move from one U.S. state to another state today. There were no passports. In 1882, Congress passed an immigration act, placing a fifty-cent head tax on immigrants. In the same year, Congress passed the Chinese Exclusion Act.

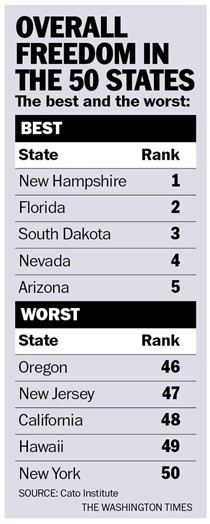

The freedom to move from state to state is a key element in maintaining our liberty. Those who do not like the tax policies in New York can pick up and move to Florida – as millions of their fellow New Yorkers have been doing. The seventh edition of “Freedom in the 50 States,” authored by William Ruger and Jason Sorens of the American Institute for Economic Research, has just been published by the Cato Institute. The study “ranks the American states according to how their public policies affect individual freedoms in the economic, social and personal spheres. … It examines state and local government intervention across a wide range of public categories – from taxation to debt, from eminent domain laws to occupational licensing, and from drug policy to educational choice.”

Where each of us chooses to live in America does not depend on public policies alone but also on such important factors as where family and friends live, climate, and recreational and job opportunities. But over the long run, Americans slowly drift from high-tax, high-regulatory states to low-tax, more freedom-enhancing states. My own family history, in many ways, reflects this America. My first European ancestors arrived in the Connecticut colony in the 1630s I expect seeking more religious liberty and economic opportunity than was available in England.

In the 1700s, some of them moved to Western New York state, probably seeking more and better farmland. A century or so ago, as was common at the time, one of my great grandfathers moved with part of his family to California – better weather and more opportunities. Shortly thereafter, another great-grandfather moved to Florida, eventually followed by my grandparents and parents. Taxes had almost nothing to do with these early migrations, but climate and opportunities in growing states were Important.

Fortunately, by the time I was growing up in Florida, air conditioning had become widespread, making the hot Florida summers very livable. Florida is now the third most populace state, having passed New York several years ago, and already Florida has a 10% larger population.

The authors of the “Freedom in the 50 States” report not only consider economic freedom, which includes taxation and government consumption, but also various regulatory policies and various personal freedoms; so, while Tennessee and Georgia have more economic freedom than Nevada and Arizona – under the authors’ weightings, the additional personal freedoms in Nevada and Arizona give them a total higher ranking. The personal freedom rankings, by necessity, have more subjective elements than the economic rankings – which should ensure lively debate.

It should come as no surprise that the five states with the highest level of overall freedom also have had large population gains, while the states with the least freedom have been losing population. New York had a population of 20.2 million in 2020 but only 19.7 million last year. By contrast, Florida had a population of 22.2 million last year, up from 19.3 million in 2014.

The New York government spends more than twice per capita than Florida, yet by most measures – such as educational performance – Florida performs far better.

The high-tax freedom-oppressing states tend to have large debt burdens relative to the freest states. Many high-income people in Manhattan are increasingly finding they can do their jobs perfectly well from Palm Beach – without the hassle of the City and its 12+% state and local income tax. As increasing numbers leave, the New York tax base is being eroded, placing a further tax burden on those who remain. California has a very progressive state income tax system – so state debt grows rapidly during economic downturns – again increasing pressures for higher taxes on those who have not fled.

Those least free and highest tax-burden states have placed themselves in an economic death spiral. As their most productive citizens leave, declining service levels, regulations, and new taxes fall on the remainders who are often the least able to afford being punished by the government.

Courageous, tough-minded political leaders with the right policies can quickly reverse these declines. Britain was widely regarded as a hopeless basket case until Margaret Thatcher was elected and reversed course. President Ronald Reagan was able to quickly renew the U.S. situation after the stagnation and malaise of the Carter administration, paraphrasing the 1630 sermon of John Winthrop, when he set forth the goal of building that “shining city on the hill.”

• Richard W. Rahn is chairman of the Institute for Global Economic Growth and MCon LLC.

https://www.washingtontimes.com/news/2023/nov/22/freedom-to-move-from-state-to-state-is-reason-to-g/

© Copyright 2023 The Washington Times, LLC.