The good news is that inflation is slowing, largely because of the reduction in money growth over the last year or so. The bad news is that the unemployment rate will increase. (It already has but is disguised by the reduction in the labor force participation rate.) Total wage income (of all workers) will continue to fall because of rising unemployment, despite fewer new price increases.

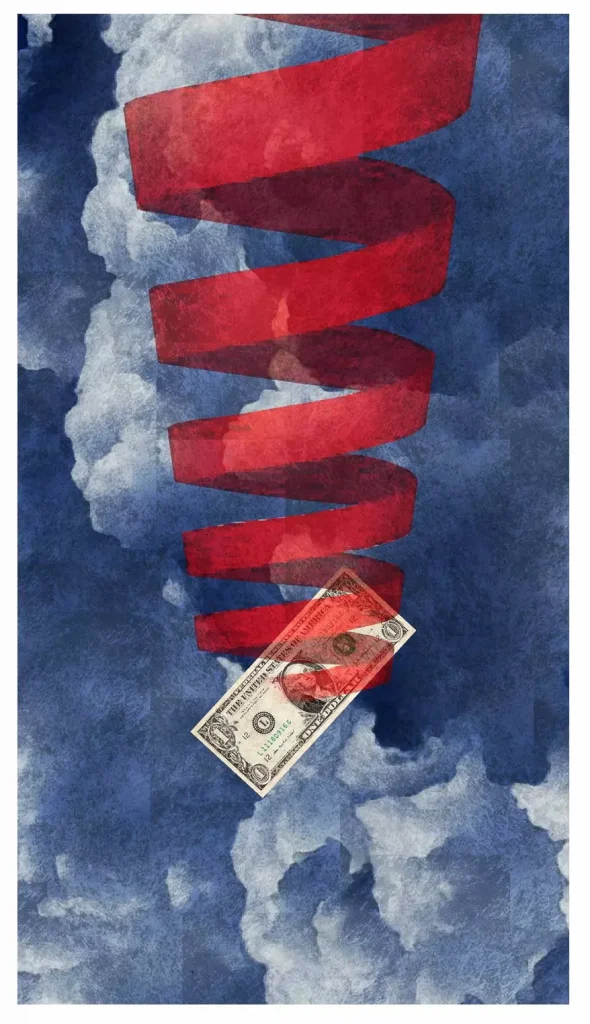

As governments moved off the gold standard a century ago and adopted fiat (unbacked) money, the temptation to print more money than the increase in the supply of goods and services could justify became too great to resist. The U.S. dollar is now worth about one-thirtieth of what it was in 1914 when the Federal Reserve was established. Unfortunately, the long-run rate of the debasement of the dollar is likely to get much worse because the U.S. and others have allowed persistent large deficits, resulting in total debt burdens of close to or exceeding 100% of their gross domestic product. When debtors, including governments, borrow just to cover interest payments, they have entered a monetary death spiral.

Persistent inflation can be stopped by reducing government spending or by increasing economic growth, which results in more tax revenue, by raising taxes to reduce the deficit, or by some combination of these. Tax increase advocates most often argue for rate increases on capital and labor (the economic seed corn), which slow economic growth and thus rarely result in increased revenue for the government and often the opposite. Tax increases on consumption are the least economically damaging, but they disproportionately hit the poor and middle class and hence are usually a nonstarter.

Pro-growth policies of reducing tax rates on labor and capital and reduced regulations will result in more tax revenue over the long run but are usually opposed by advocates of big government. Reductions in the rate of government spending can narrow the deficit, but again, the government advocates rarely find a spending program that they are willing to reduce. About two-thirds of government spending is for the so-called entitlements (Social Security, Medicare, Medicaid, etc.), and a majority of the members of both parties are afraid to implement the necessary reforms in those programs. Twelve percent of the budget goes for military spending — and given the current world situation, military spending is more likely to be increased rather than cut. Finally, interest on the debt accounts for 10% of spending and is rapidly rising. In sum, all spending rate reductions will have to come out of the remaining less than 20% or so of the budget — and even if all of that spending were entirely eliminated, the budget still would not be balanced.

Inflation is self-correcting but after much pain. As the debasement of the currency increases, reducing everyone’s purchasing power, the value of the government debt is also eroded to the point where it once again is manageable. Thirty years ago, this scenario played out in the Eastern European countries and the former Soviet Union. If you are old enough, you may recall the economic collapse of these countries. Many of them went through a period of hyperinflation where the currency became essentially worthless. The people were impoverished and quickly turned to barter and the use of foreign currencies like the U.S. dollar and the German mark to survive. New central banks and new currencies were created. A number of the countries established “currency boards,” where the new currency was 100% or more backed by foreign currencies (largely lent by the U.S. and other foreign governments and the International Monetary Fund) plus whatever gold reserves they had. Having suffered a currency collapse, the new political class in those countries frequently established strong restrictions on deficit spending to avoid a repeat of the disaster.

It is ironic that many countries with the strongest balance sheets (very little debt) and growing prosperity are former socialist countries. Estonia has a debt of only 7% of its GDP, and even Russia has a relatively small debt, enabling Vladimir Putin to finance his war in Ukraine with oil revenue rather than deficit spending.

Argentina has gone through a number of excessive deficit spending “death spirals” in the last 70 years or so. The currency becomes close to worthless, the people lose their savings (except for those who have foreign currency bank accounts), and foreign bondholders take it on the chin. But the IMF always came in with a bailout package to recapitalize the central bank and to establish a “sound currency” with the solemn pledge by the Argentine government officials not to do it again — and the naive IMF officials believed them (after all, it was not their money), and the pattern repeated.

The U.S. death spiral will be different because neither the IMF nor foreign governments are big enough to do a bailout. As inflation rapidly rises again, too few buyers for new government debt issues will emerge, forcing the government to reduce full inflation indexing of “entitlements” and other spending. The government will then be forced to adopt a pay-as-you-go budget with no deficit financing. The debt will have largely disappeared as a result of the inflation, enabling the government to start over after great economic pain with new fiscal and monetary rules and, if properly done, will lead to a new and higher level of growth and prosperity.

• Richard W. Rahn is chairman of the Institute for Global Economic Growth and MCon LLC.

https://www.washingtontimes.com/news/2023/jul/17/long-run-debasement-of-us-dollar-likely-to-get-muc/

© Copyright 2023 The Washington Times, LLC.