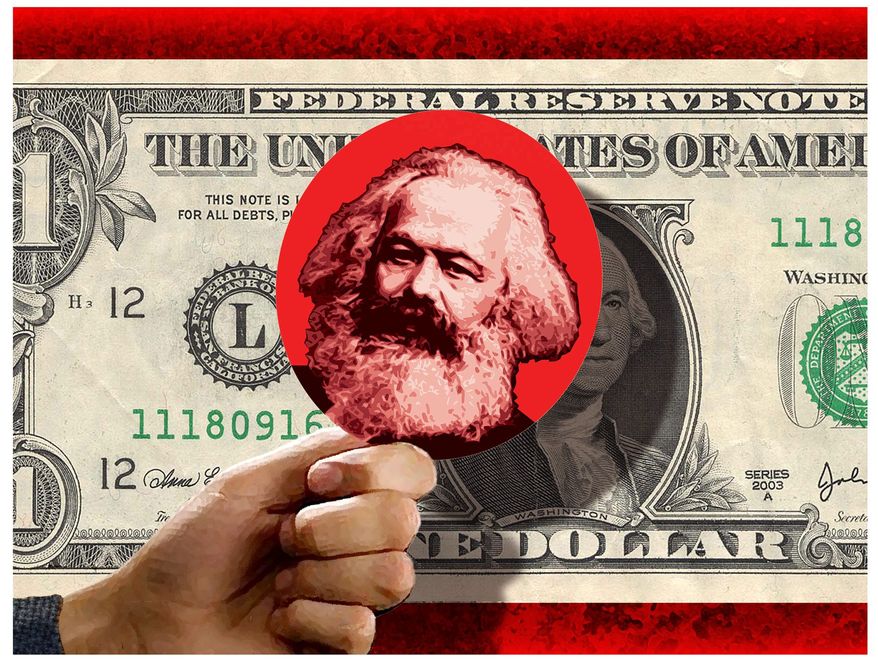

END OF THE U.S. DOLLAR MONOPOLY?

China and Russia have announced they, along with Brazil, India and South Africa, are “working to develop a new global reserve currency” to compete with the U.S. dollar.

The U.S. dollar has been the world’s currency since the end of World War I, when it replaced the British pound as the preferred reserve and transactional currency. Until the end of World War II, much of the world was still on the gold standard, but that ended in 1971 when the U.S. closed the “gold window.”

In many ways, countries hostile to the U.S. are being held hostage to the USD. China and Russia, as well as most other countries, hold the majority of their foreign reserves in USDs. Almost all global commodities, such as oil, corn, sugar, coffee, copper and aluminum, are priced and traded in USDs. This gives the U.S. a unique ability to apply financial sanctions on foreign countries, by doing such things as freezing their USD-denominated bank accounts and limiting their ability to clear trading transactions and investments. Approximately two dozen countries are under some sort of economic sanction or restriction by the U.S.

Over time, countries find ways around sanctions, but the workarounds tend to be costly and cumbersome. Cuba has been coping with U.S. sanctions for more than half a century. Russia, after the initial shock of having many of its USD accounts frozen or blocked and its access to the global financial clearing systems stopped or limited, has already found alternative methods of paying for imports and being compensated for its exports — often at discounted prices.

It is not only countries that are under sanction that resent being tied to the USD, but also friendly countries, which are well aware that they could also face some sort of economic restriction anytime they sufficiently irritate some group of U.S. politicians. Being the world’s global reserve and transactional currency does place an added burden on U.S. policymakers to be prudent and not engage in inflationary monetary policies or reckless fiscal policies. Unfortunately, the Federal Reserve, Congress and the administration have all been irresponsible in the last several years.

As noted, China and Russia in particular are working feverishly to create an alternative to the USD and are creating clearing accounts with each other. The USD’s share of China-Russia trade settlements has dropped from about 90% in 2015 to an estimated only 40% this year. (As an aside, on one of my trips to China a couple of decades ago, I was visiting with officials at the country’s central bank — several of whom had degrees in economics from the University of Chicago. Even back then, they were exploring alternatives to the USD. All of their bank notes — Chinese currency — had a picture of Mao. I could not help but quip that I didn’t think that the world was ready to accept bank notes with a picture of a mass murderer. At the time, relations were good between our two countries, so they took it with good humor.)

If China and Russia went back on the gold standard and encouraged other countries to so the same, the problem of USD tyranny (from their standpoint) would be solved. But it is not that easy. It is estimated that approximately 20% or so of the world’s gold reserves are held by governments, which is large enough for them to destabilize the price of gold at any time, but far short of the amount of gold that would be needed to back a currency, unless the price of gold rose severalfold — which would bring on another set of problems.

The Chinese and other governments often keep their gold purchases secret. It is known that the Chinese have been buying large quantities of gold. They may have acquired 4,000 tons or so, which is still only half as much as the U.S. — more than 8,000 tons. The Russians are estimated to hold 2,300 tons, a little less than France and a little more than Switzerland. These estimates are only for holdings by central banks. Private institutions and individuals worldwide probably own about 80% of the gold, but no one knows for sure.

Russia and China, and perhaps a couple of other natural resource countries, may try to create a basket of commodities — using their reserves of oil, natural gas, coal, copper, bauxite (aluminum), and their above-ground holdings of gold and silver — as backing for their money, if their current basket of currencies scheme does not work out. A commodity basket could work, provided that those who might hold this currency had faith in the rule of law and stability of the countries providing the reserves — and that is a big if!

Even if U.S. inflation accelerates, causing the dollar to lose most of its purchasing power, it is hard to envision any group of countries being able to create a new global currency. What is likely to happen is that many private organizations will create crypto- or commodity-backed substitutes for government fiat currencies that will in part serve as a store of value and unit of account, and a few will probably be successful.

• Richard W. Rahn is chairman of the Institute for Global Economic Growth and MCon LLC.

https://www.washingtontimes.com/news/2023/mar/6/russia-and-china-may-try-using-their-natural-resou/

© Copyright 2023 The Washington Times, LLC.