To preserve your wealth, should you invest in stocks, bonds, other financial instruments, gold and silver, real estate, collectibles, or commodities? Yes, all of them, but in what proportion? Two years ago, many economists were forecasting a recession for last year, but surprise-surprise the economy grew by more than 3% in the last quarter, and the stock markets have reached record highs.

Why were so many so wrong? As the great Austrian economist F. A. Hayek would have explained too many were engaged in the fatal conceit of having knowledge they could not possess. Economics is not like physics, where the reaction to any given action can be precisely measured. Markets are a reaction to the statements and actions of millions of individual government policymakers, business and labor leaders, and consumers. Unanticipated events such as wars, natural disasters, and technological advances – all have an impact. Despite these limits, the long-run consequences of certain policies and events can be forecast with some certainty.

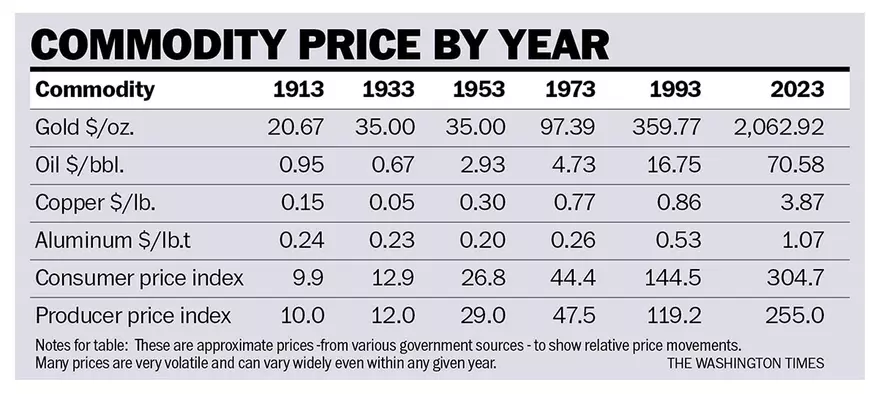

Government spending in the major economies – notably the U.S. – is growing at a rate faster than economic or tax revenue growth. Obviously, this cannot continue, even though the political will to make the necessary changes is lacking. The result is that government monies are becoming increasingly worthless. It now takes about 30 USD to buy the same market basket of goods that it did in 1913. Americans are suffering sticker shock when they go to the grocery store. The ever-growing deficits will lead to more and variable rates of inflation until a panic sets in leaving the currency almost worthless – as it did in Germany in the 1920s, Ukraine and Russia in the 1990s, and most recently Argentina, etc. etc.

Under such conditions, the prudent person would limit the amount of wealth they have in bonds and various types of fixed-income savings and money market accounts. Almost all financial wealth, except for physical dollars, is held in custodian accounts managed by a bank, brokerage firm, or other money management institution – and overseen and controlled by a government agency. If the government declares an emergency, as was done in 1933, everyone’s financial accounts can be frozen and even seized – leaving people without access to their savings.

Many people hold gold (and silver) as part of their wealth preservation – without fully understanding the risk. The price of gold was fixed by the U.S. Treasury in 1834 and remained constant until President Franklin D. Roosevelt made private ownership of gold illegal. He then increased the number of dollars required to purchase an ounce of gold until settling on a price of $35.00 an ounce. In effect, this was wealth confiscation – done without legislative action or a Constitutional amendment. President Richard Nixon raised the price of gold to $42 an ounce and once again allowed private ownership of gold. The gold market has been relatively free since 1973, but central banks own more than 20% of the known world gold reserves, so their purchases and sales can cause major price disruptions.

Real estate has long been considered an ideal asset for wealth preservation, provided that the purchaser buys it at the right point in the real estate cycle and is capable of holding it for a long time if necessary. Most of those who bought Florida residential or commercial properties a decade ago are very happy. Those who bought New York office buildings or retail space in San Francisco are likely to be very unhappy. Buying some recreational or hobby farmland in a desirable location with the intent of holding and enjoying it for many years is usually a wise decision – provided that it is unencumbered by a mortgage, which could enable the holder or custodian to seize it.

Keeping wealth in collectibles, such as art, jewelry, rare books, and antique cars, has long served as some protection against rapacious government. Guns, and particularly ammo, can serve as good monetary hedges, given that they are liquid and easily dividable. How many .22 cartridges for a loaf of bread?

Widely traded commodities that can be stored for long periods of time are a good hedge against dysfunctional currencies. Oil would be ideal, but governments frequently attempt to control oil prices and engage in considerable interventions for political reasons.

Non-precious and highly useful metals like copper and aluminum will always have value. The price of copper has fallen slightly in inflation-adjusted terms over the last 60 years but has been subject to major price swings. The price of aluminum, the most useful of all metals, has fallen in real inflation-adjusted terms more than any other metal up to the last 30 years, primarily due to technological improvements. Aluminum and copper should be ideal hedges against inflation because they will always have real value and are so widely used, traded, and owned, making it difficult to seize or regulate them. The problem is that they are bulky and expensive to store. The good news is that entrepreneurs are developing ways to digitize and tokenize them, making them liquid, in any amount, at a low cost.

In sum, the best way to preserve wealth is not by trying to outguess markets and global events but by diversifying and holding some financial, precious metal, real estate, and commodity metal assets. It is wise to adjust the relative proportions of each type of asset in response to political and/or economic events.

• Richard W. Rahn is chairman of the Institute for Global Economic Growth and MCon LLC.

https://www.washingtontimes.com/news/2024/jan/29/search-for-wealth-preservation-invest-in-diversifi/

© Copyright 2024 The Washington Times, LLC.