A DOOMSDAY GUIDE

Each morning, we wake up and turn on the news, thinking things cannot get worse — but they do. From the beginning of the COVID-19 pandemic, most things have gone downhill. So how do you protect your family when previously low-probability events such as nuclear war and a financial meltdown become somewhat more probable?

Those in charge of economic policy have shown they have little idea of what they are doing as inflation soared and shows no signs of ending and real wages have lagged. Many leaders — from the military, government health agencies, the foreign policy establishment, the Justice Department, the FBI and local governments, from the big cities to the president and Congress — have demonstrated much incompetence and corruption and lost the support of the majority of Americans.

Despite the headwinds from the above, good citizens still try to take care of their children and do a responsible job at whatever work they do. They all have the same question: “How can I protect my family from an increasingly malevolent world?”

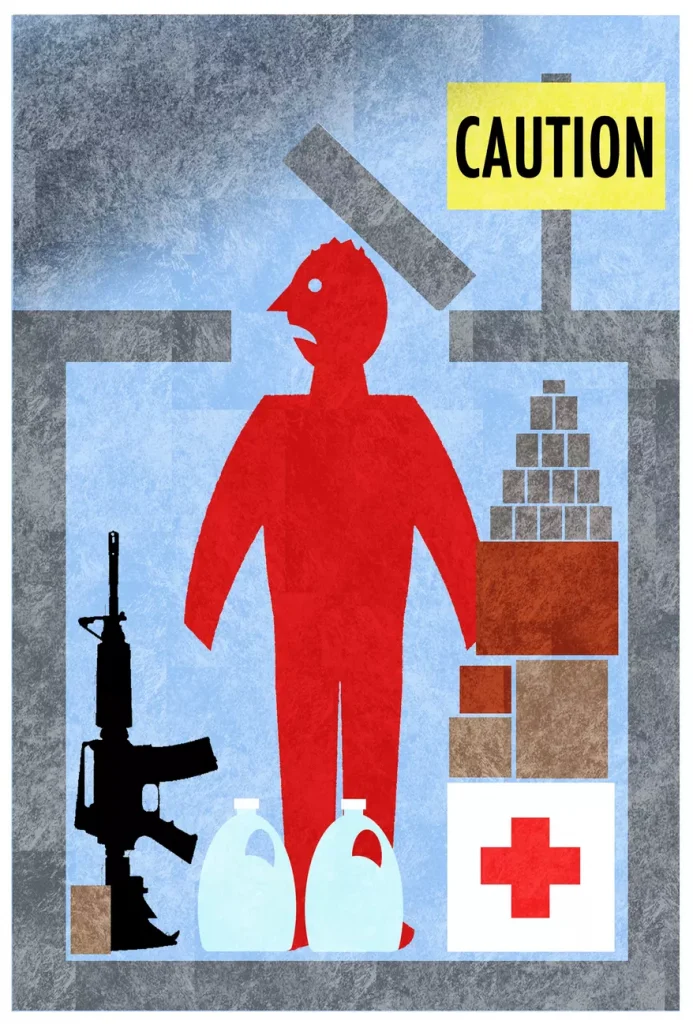

Of primary importance is safety. The good news is that outside some major cities, crime rates are low in most of the country, and first responder services are first-rate. If you live in a high-crime area, move. The bad news is, as the government fiscal situation deteriorates, the number of police officers and fire personnel is likely to be cut. Having a first aid kit and basic first aid training is always wise, as is owning a gun that one knows how to safely use in case the police cannot arrive in a timely fashion. One major piece of good news on the safety front is that by far and away, the largest cause of accidental deaths is automobile crashes, mostly due to driver error. The self-driving car, which will soon be widespread, will eliminate most of these deaths.

There is a small but rising, nonnegligible chance of nuclear war, widespread terrorism, or a breakdown in civil order — all most likely to be confined to large urban areas. (All bets are off with a major nuclear war, making personal hedging strategies moot.) If you live in a place like New York, it would be prudent to have a rural location to which you can flee. Increasing numbers of homes have “safe rooms” or areas, which is wise. The cost of a six-month supply of nonperishable food is low, even if the chances of needing it are slim. (Six months should be long enough for supply lines to be reestablished and the return of basic order.) Many good “how to survive” books are available, and having a hard copy, not an electronic version, is cheap insurance.

Every day, we get bombarded with “the coming bank failure and financial collapse” letters, books, etc. The doomsday authors of these tracts are likely to eventually be correct — for the simple reason that the federal debt in the U.S. and many other countries is growing much faster than revenue, which at some point becomes unsustainable. The U.S. has passed the point where the problem can be solved with tax increases (which will only serve to slow growth even more). In theory, the problem can be solved with real spending reduction, but in a democracy, given the amount of reduction required, it is nearly impossible. The most likely scenario, rather than a sudden economic collapse, is inflation at uneven rates, which erodes the value of debt but makes the people poorer. Argentina is perhaps the best example of what might happen. Argentina was one of the richest countries in the world, with a functioning democracy. But it elected Juan Peron in 1946, and he and his followers began a period of fiscal irresponsibility that has persisted, resulting in periods of high inflation and the impoverishment of the nation.

Governments in high-inflation economies often resort to drastic measures like wage and price controls, which always fail and often lead to more draconian regulations, further eroding basic civil liberties. The choices then become to throw out all of those who caused the problem and institute a new currency with a balanced budget requirement or descend further into corruption and tyranny — the fate of Rome and many others.

As in good times, in worse times, individuals are also best off diversifying their assets — real estate, precious and nonprecious metals, other real assets like classic cars, inflation-indexed bonds, and selected stocks that can do well in inflationary times. Moving some assets to more stable and economically responsible countries can work until the point that assets held anywhere become subject to destructive taxation or seizure.

The good news is that, unlike previous periods of countries saddled with bad governments, technology is advancing at an exponential rate. The biological sciences are advancing as fast as solid-state physics and medical care are likely to become faster and less expensive each year. Advanced robots and chemistry will make basic food so plentiful and inexpensive that no one will go hungry. The cost of building homes and infrastructure will plummet in real terms as designs go directly to construction robots. My hope (or perhaps wishful thinking) is that these wealth-producing changes might make corrupt and incompetent governments increasingly irrelevant.

• Richard W. Rahn is chairman of the Institute for Global Economic Growth and MCon LLC.

https://www.washingtontimes.com/news/2023/oct/16/what-is-prudent-person-to-do-doomsday-guide/

© Copyright 2023 The Washington Times, LLC.