BIG-SPENDER STATES OFFER FEWER BENEFITS THAN THEIR MORE PRUDENT PEERS

There are unpredictable disasters, like earthquakes, and predictable disasters, like deaths caused by a war. And there are predictable disasters, like a surge in crime stemming from abolishing bail, as the state of Illinois has just begun, that can be averted.

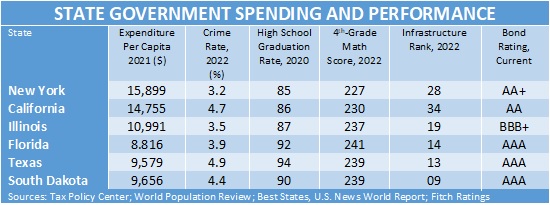

Politicians often complain that they don’t have enough money to fund basic government responsibilities. Yet the data tells a different story. A number of states with lower overall government spending perform much better than some of the states that spend the most. New York, California and Illinois are examples of big states that deliver a fraction of the benefits to their residents per dollar spent compared with what big states such as Texas and Florida accomplish.

In the table included, note that New York spends almost twice as much as Florida at the state and local level but performs less well in almost all categories. The one exception is crime, where New York’s crime rate had been slightly lower than Florida’s (due to the legacy of New York City Mayors Rudy Giuliani and Michael Bloomberg), but that is all about to change. The city now has a “woke” district attorney and has gone to cashless bail, so the disincentives for being a criminal are being greatly reduced.

New York spends more than twice as much per school-age child but has much worse educational outcomes than Florida, Texas or South Dakota (the freest state, according to its governor, Kristi Noem). Florida has embraced school choice so that parents can pick the public, charter, private, parochial or home-school system that best meets their child’s needs. Because Florida has real school competition, it provides more and better alternatives at a lower cost than state monopoly schools controlled by teachers unions. (Note in the table that high school graduation rates and fourth grade math scores on standardized tests serve as good proxy for overall educational performance.)

When the newest crime statistics are available (there is about a two-year lag), the bet is that New York, California and Illinois will all show a significant increase in crime — both because of policies that hinder law enforcement and because they all now have sanctuary cities, which attract a disproportionate number of so-called migrants (more correctly, illegal aliens). Most of the illegals are not working, so they take whatever they think they need above the welfare benefits that government and private charities provide (a predictable disaster). In the meantime, crime rates in Florida are falling as a result of tougher enforcement and the removal of “woke” prosecutors by Gov. Ron DeSantis.

Florida, Texas and South Dakota have been spending considerable funds to upgrade and expand their infrastructure — mainly to provide better transportation and protection from hurricanes and other storms (a known risk). New York and California have lagged in infrastructure spending, which is obvious when you travel around those two states. It’s also a safe bet that Florida and Texas get more for each dollar spent for infrastructure because of less unionization of the construction trades and a tradition of less corruption than Illinois, California and New York.

A good measure of the quality of state management and fiscal responsibility is a state’s bond rating. Florida, Texas and South Dakota all have triple AAA bond ratings (the top). New York and California have lower bond ratings, and Illinois has the dreadful triple B, which means there is a considerable risk of default. State and local governments strive to get high bond ratings because it means they can pay lower interest rates on their bonds. (It is sadly ironic that Florida, Texas and South Dakota have no state income tax, while New York and California have the highest state income tax rates.)

What does not bode well for the future of New York, Illinois and California is that by bragging about their sanctuary cities — where illegal aliens have a “right” to shelter, food, medical care, and other benefits — they have lost control over their budgets. If a sizable and growing group of residents has unlimited demand for city services, it is only a matter of time before the city goes bankrupt — a very predictable disaster.

What is also very predictable, as the sanctuary cities run out of money, they will petition Congress for bailouts – without explaining why the responsible people of Florida (the ants) should bail out the irresponsible people (the grasshoppers) of Illinois.

Also predictable is the migration of productive taxpayers from New York and California to Texas and Florida will not abate. The new mayor of Chicago is proposing that the city build supermarkets in the neighborhoods where traditional markets have left because of looting. Two questions: Do looters care whether the city or Safeway owns the market? Does the new mayor have any awareness that the state-owned markets in Eastern Europe and the Soviet Union under communism — with empty shelves and bad food — were a disaster?

What are the odds that Chicago will have food riots in the poor neighborhoods and the city will go bankrupt? A predictable disaster.

• Richard W. Rahn is chairman of the Institute for Global Economic Growth and MCon LLC.

https://www.washingtontimes.com/news/2023/oct/2/predictable-disasters-big-spender-states-offer-few/

© Copyright 2023 The Washington Times, LLC.